GLOBAL EUROPE

Europe's Trade Defence Instruments in a changing global economy

A Green Paper for public consultation

Questionnaire

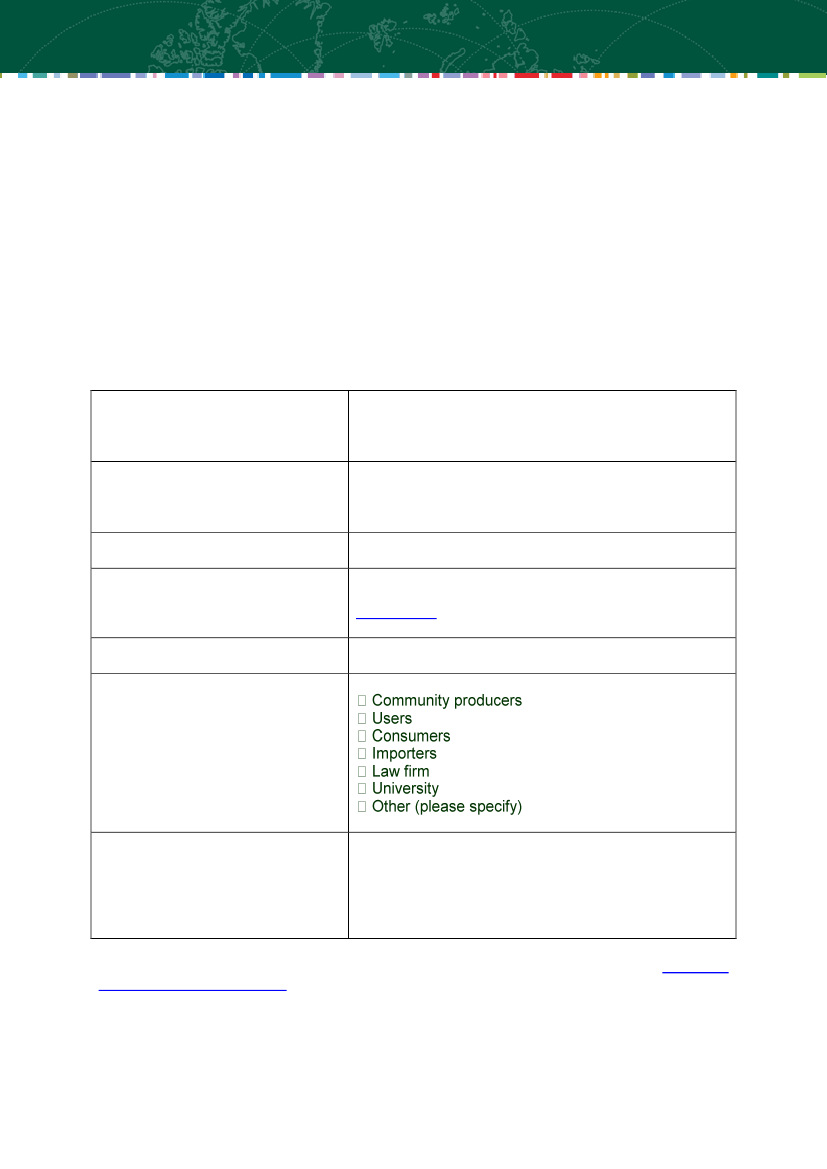

Name of organisation/individual Government of Denmark

Ministry of Economic and Business Affairs

National Agency for Enterprise and Construction

Address of organisation/individual Dahlerups Pakhus

Langelinie Allé 17

DK-2100 Copenhagen

Country Denmark

Telephone +45 35 46 60 00

Fax +45 35 46 60 01

e-mail

Date of submission 30 March 2007

Organisation/individual belonging to X public administration

the following category

If organisation, please provide

some economic key figures, e.g.

turnover and employment and any

other figure that you consider

relevant.

Replies to the questionnaire should reach the Commission by

31 March 2007

at:

Trade-tdi-

Comments received will be made available on-line unless a

specific request for confidentiality is made, in which case only an indication of the contributor

will be given.

1