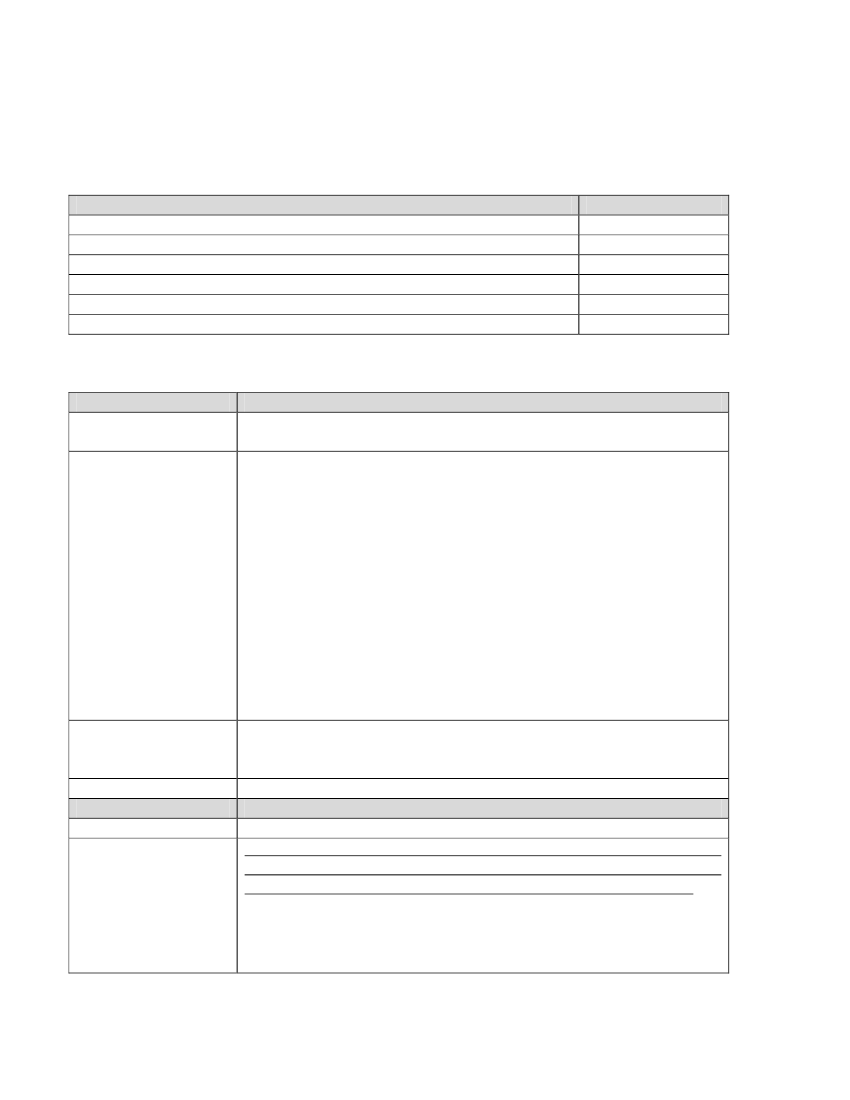

Danish proposals for simplification

- fast track actions and proposals for priority areas

Area of the proposal

Company Law

Maritime

Financial

Statistics

Environment

Total

Fast track proposals

1

Legislation

Need for

simplification

September 2007.

No. of proposals

5

3

4

2

1

15

Company Law

3

rd

Council Directive of 9 October 1978 (78/855/EEC) and 6

th

Council Directive of 17 December 1982 (82/891/EEC)

In case of a merger and division both a draft terms and a statement

are required.

The draft terms, that are to be drawn up by the administrative or

management bodies, must contain a series of information regarding

amongst other things the type, name and registered office, the share

exchange ratio and the amount of any cash payment to the

stockholders in the dissolving companies. The management body

must in the statement explain and justify the plan. The statement must

furthermore explain the fixing of cash payments to stockholders.

Practice has shown that there is a considerable overlap between the

two documents. To this must be added that the statements are often

futile and therefore of very little practical use for the stockholders.

On this regard it is recommended that the demand of a statement in

case of a merger or division is abolished or alternatively that the two

documents are compiled into one.

€ 169.718 + € 74.384

Company Law

3

rd

Council Directive of 9 October 1978 (78/855/EEC)

Report done by an impartial assessor in case of a merger where the

continuing company is a public limited company and one of the

dissolving companies is a private company (3

rd

council directive).

Where shares are issued for a consideration other than in cash in the

course of an increase in the subscribed capital there is in the 2

nd

council directive an obligation for the companies to present a report

Proposal for

simplification

Reductions

2

Legislation

Need for

simplification