Europaudvalget 2010-11 (1. samling), Det Udenrigspolitiske Nævn 2010-11 (1. samling)

EUU Alm.del Bilag 39, UPN Alm.del Bilag 9

Offentligt

STRENGTHENING ECONOMIC GOVERNANCE IN THE EU

REPORT OF THE TASK FORCE TO THE EUROPEAN COUNCIL

Brussels, 21 October 2010

STRENGTHENINGECONOMICGOVERNANCE IN THEEUFINALREPORT OF THETASKFORCE TO THEEUROPEANCOUNCILEXECUTIVESUMMARYThe financial crisis and the more recent turmoil in sovereign debt markets have clearly highlightedchallenges in the European Union’s economic governance.To address these challenges, a fundamental shift in European economic governance is needed,commensurate to the degree of economic and financial integration already achieved through themonetary union and the internal market. The recommendations in the Task Force Report address thehigh degree of economic inter-dependence, particularly in the euro area, while preserving nationalresponsibilities on fiscal and economic policies. The recommendations should be implemented infive main directions:1. Towards greater fiscal disciplineThe budgetary surveillance framework currently in place, defined in the Stability and Growth Pact(SGP), remains broadly valid. However, it needs to be applied in a better and more consistent way.In particular, there is a need for a greater focus on debt and fiscal sustainability, to reinforcecompliance and to ensure that national fiscal frameworks reflect the EU's fiscal rules.The criterion of public debt needs to be better reflected in the budgetary surveillance mechanism bypaying greater attention to the interplay between deficit and debt. Therefore, the Task Forcerecommends to operationalise the debt criterion in the Treaty by defining an appropriatequantitative reference, and to apply it effectively--due account taken of all relevant factors-- notablyas a trigger in the excessive deficit procedure.To increase their effectiveness in the future, a wider range of sanctions and measures, of bothfinancial and reputational/political nature, should be applied progressively in both the preventiveand the corrective arms of the SGP, starting at an earlier stage in the budgetary surveillance process.Fairness, proportionality and equal treatment between Member States must be ensured.The recommended political and reputational measures range from enhanced reporting requirementsto ad-hoc reporting to the European Council, and enhanced surveillance, eventually followed by apublic report.The recommended financial sanctions range from interest-bearing deposits to fines. They will befirst applied to euro area Member States only. As soon as possible, and at the latest in the context ofthe next multi-annual financial framework, the enforcement measures will be extended to allMember States1, by making a range of EU expenditures conditional upon compliance with the SGP.A more effective compliance regime will also be brought about by a higher degree of rule-baseddecision making. Therefore it is proposed to introduce a reverse majority rule for the adoption ofenforcement measures. This means in practice that Commission recommendations would beadopted unless a qualified majority of Member States in the Council votes against within a givendeadline.

1

Except the UK as a consequence of Protocol 15 of the Treaty.

1

A set of agreed minimum requirements for national fiscal frameworks needs to be met before theend of 2013, covering the essential areas. Moreover, a set of non-binding standards should beagreed upon. The Commission and the Council will assess the national fiscal frameworks.The task Force also recommends a number of measures to further strengthen Eurostat and theEuropean statistical system.2. Broadening economic surveillance: a new surveillance mechanismThe global crisis has demonstrated that compliance with the Stability and Growth Pact is notsufficient to ensure balanced growth in the EU.The Task Force therefore recommends the introduction of a new mechanism for macroeconomicsurveillance underpinned by a new legal framework alongside the budget-focused SGP.An annual assessment of the risk of macroeconomic imbalances and vulnerabilities will beundertaken, using an alert mechanism based on a limited number of indicators. In case of actual orpotential excessive imbalances, the Commission should conduct an in-depth analysis. In particularlyserious cases, an "excessive imbalance position" should be launched by the Council, with a deadlineto take a set of policy measures to address the problem. Euro area Member States may ultimatelyface sanctions in case of repeated non-compliance.3. Deeper and broader coordination: the ‘European Semester’One of the earliest Task Force recommendations to reinforce policy coordination, the so-called"European semester", has already been decided and will be implemented as of 1st January 2011.Each spring, it will allow a simultaneous assessment of both budgetary measures and structuralreforms fostering growth and employment. This will contribute to ensure that the EU/euro areadimension is better taken into account when countries prepare budgets and reform programmes.4. Robust framework for crisis managementSince the creation of the Task Force, the European Financial Stability Facility (EFSF) for the euroarea and the European Financial Stability Mechanism (EFSM) have been set up and are now fullyoperational, offering therefore a good line of defence for the next three years.The Task Force considers that in the medium term there is a need to establish a credible crisisresolution framework for the euro area capable of addressing financial distress and avoidingcontagion. It will need to resolutely address the moral hazard that is implicit in any ex-ante crisisscheme. The precise features and operational means of such a crisis mechanism will require furtherwork.5. Stronger institutions for more effective economic governanceStronger institutions both at national and EU level will contribute to improve economic governance.At the national level, the Task Force recommends the use or setting up of public institutions orbodies to provide independent analysis, assessments and forecasts on domestic fiscal policy mattersas a way to reinforcing fiscal governance and ensuring long-term sustainability.***

2

These recommendations are in line with the mandate given by the European Council of 25-26March 2010 and with the interim report delivered by the President of the European Council to theEuropean Council in June and September. The implementation of the Task Force recommendationswill result in a substantial strengthening of the economic pillar of the Economic and MonetaryUnion. It will enhance confidence and contribute to sustainable growth.Adoption of the secondary legislation on the basis of Commission proposals will be needed for theimplementation of many of these recommendations. The Task Force calls on all parties to opt for a"fast track" approach, to ensure the effective implementation of the new surveillance arrangementsas soon as possible.

1.

INTRODUCTION

1. The Task Force was established by the European Council of 25-26 March 2010 with themandate to present, before the end of this year, the measures needed to reach the objective of animproved crisis resolution framework and better budgetary discipline, exploring all options toreinforce the legal framework. The European Council of 17 June 2010 agreed with the firstorientations from the Task Force and looked forward to their Final Report in October this year.2. This Report outlines the main policy recommendations and concrete proposals agreed on by theTask Force and suggests further steps for their implementation. It aims at achieving a "quantumleap " in terms of more effective economic governance in the EU and the euro area, to beimplemented in five main pillars:(i) fiscal discipline, notably through a stronger Stability and Growth Pact(ii) broadening economic surveillance to encompass macro imbalances and competitiveness(iii) deeper and broader coordination(iv) a robust framework for crisis management(v) stronger institutions and more effective and rules-based decision making3. These proposals aim at reflecting the specific features of the EU economic and monetaryintegration. The key challenge is to address the extremely high degree of inter-dependence,particularly in the euro area, as clearly highlighted by the recent crisis, while preserving nationalresponsibilities on fiscal policy.4. Given the urgency of a reinforced coordination of economic policies in the European Union as awhole, and in view of a swift implementation, all the recommendations by the Task Force aimto exploit to the maximum all the possibilities that EU secondary legislation can offer within theexisting legal framework of the European Union. These recommendations should beimplemented as soon as possible.2.2.1POLICY RECOMMENDATIONSTowards greater fiscal discipline

5. The budgetary surveillance framework is key for ensuring fiscal discipline and the sustainabilityof public finances in the medium and long term. The Task Force's recommendation is tostrengthen budgetary surveillance and reinforce compliance with EU budgetary rules. Allelements presented in this section aim at a better and more consistent implementation of theStability and Growth Pact (SGP), so as to provide a strong basis for ensuring long-term fiscalstability across the European Union.3

2.1.1 Strengthening the focus on fiscal sustainability6. The Task Force recommends that the criterion of public debt be better reflected in the budgetarysurveillance mechanism.7. This recommendation is in line with the rationale of the Treaty and the SGP. In practice,however, the implementation of the SGP has focused so far mainly on the deficit criterion. Forthe future, the Task Force recommends to give more prominence to public debt and fiscalsustainability in the budgetary surveillance framework. High indebtedness is a drag on medium-and long-term growth prospects, aggravates the risk of financial instability and reduces theability to run counter-cyclical fiscal policies when the need arises. Reducing debt levels is alsoparticularly important in view of the ageing populations and the impact of the recent bankrescue packages.8. More attention should be given to the interplay between deficit and debt, and the debt criterionas defined in the SGP should be made operational to be effectively applied.9. In the preventive arm of the SGP, a faster adjustment path towards the medium-term objectives(MTO) should be required for Member States faced with a debt level exceeding 60% of GDP orwith pronounced risks in terms of overall debt sustainability.10. In the corrective arm of the SGP, the Task Force recommends assessing in the Excessive DeficitProcedure (EDP) whether the budget deficit is consistent with a continuous, substantial andsustainable decline in the debt-to-GDP ratio. Therefore, bringing the deficit below 3% of GDPshould not be sufficient for the abrogation of the EDP if the debt has not been put on asatisfactory declining path. Similarly, Member States with debt ratios in excess of 60% of GDPand a deficit below 3% of GDP would become subject to the EDP unless the decline of debt in agiven preceding period is considered satisfactory.11. The precise quantitative criteria, methodology and phasing-in provisions for assessing whetherdebt is declining on a satisfactory pace shall be defined and will be set out in the secondarylegislation and/or the Code of Conduct. Taking into account that public debt dynamics is notonly driven by the budget deficit, an assessment will be needed before launching an EDPprocedure on the basis of the debt criterion. All relevant factors should be taken into account asoutlined in the Commission proposal when assessing the satisfactory pace of debt reduction.12. Specific attention should be paid to the impact of pension reforms in the implementation of theSGP, such as the setting up of a mandatory second pillar, on debt and the deficit.2.1.2 Reinforcing compliance13. The recent economic crisis has proved the need for enhancing the credibility and effectivenessof EU fiscal rules through stricter enforcement mechanisms in order to increase incentives forapplying EU rules and recommendations and to prevent undesirable fiscal developments inMember States.

4

14. To increase their effectiveness in the future, a wider range of sanctions and measures, of bothfinancial and reputational/political nature, should be applied progressively in both thepreventive and the corrective arms of the SGP, starting at an earlier stage in the budgetarysurveillance process. Fairness, proportionality and equal treatment between Member Statesshould be ensured. However, the Task Force considers that differentiation in the timing anddegree of enforcement of the SGP between euro area and non-euro area Member States iswarranted by a higher level of integration and inter-linkages within the euro area compared tothe EU as a whole.15. The Task Force recommends complementing the existing sanctions under the SGP through thefollowing measures:a) Enlarging the spectrum of available measures to ensure stricter compliance16.New reputational and political measures,that should be phased in progressively would beintroduced:-Recommendations and new reporting requirements would be introduced in the preventivearm of the SGP in the case where a Member State's adjustment path was consideredinsufficient.When a Member State does not implement a recommendation from the Council, the Counciland Eurogroup would address a formal report to the European Council.When a Member State is subject to enhanced surveillance under the SGP, on-site monitoringvia a mission of the European Commission, in liaison with the ECB for euro area MemberStates and ERM II participants, would also be carried out. Those missions should befollowed by a report by the Commission to the Council that may be made public.

--

17.New financial enforcement measuresin relation to the Stability and Growth Pact should alsobe introduced.18. The objective over the medium-term would be to include all Member States in the enforcementmechanism, having due regard to the specific situation of the UK in relation with Protocol 15 ofthe Treaties. However, atwo-stage approach,starting with the euro area, is considered as apragmatic way forward given the need to act rapidly to reinforce the SGP in the euro area whichhas a higher degree of integration:(i) In thefirst stage,additional enforcement measures such as interest-bearing deposits and non-interest-bearing deposits and fines will be introducedonly for the Euro areaon the basis ofArticle 136 of the Treaty on the Functioning of the European Union (TFEU).(ii) In asecond stage,strengthened enforcement measures need to be implemented forall EUMember States,except the UK as a consequence of Protocol 15 of the Treaty, as soon aspossible, and at the latest in the context of the next Multi-annual Financial Framework. Thisneeds to be done by introducing conditionality rules on compliance with the SGP requirementsin the relevant regulations on EU expenditures. The scope should be as broad as possible andthe setting up must ensure a level playing field and equal treatment between Member States(enforcement measures should for example be defined as a percentage of GDP). Enforcementmeasures should in principle be implemented through the same steps as in the euro area.

5

b) Introducing sanctions for euro area Member States at an earlier stage and on aprogressive basis19. The present section describes what should be done in the first stage, for enforcement measuresrelated to the euro area, on the basis of secondary legislation based on article 136. For non-euroarea countries, no change would intervene in the procedure in this first stage.20. The Task Force recommends introducing the following measures in thepreventive part of theSGP.Sanctions would be triggered if a Member State, even with a deficit below 3%, deviatessignificantly from the adjustment path foreseen in the SGP and does not correct the deviation.The assessment of compliance under the preventive arm would be based on the change in thestructural deficit. This will include an assessment of expenditure developments net ofdiscretionary tax changes. The exact methodology and parameters for this assessment shall bedefined in the secondary legislation and/or the Code of Conduct.21. The procedure to implement this measure would be based on the following steps:-In case of significant deviation from the adjustment path, the Commission shall issue anearly warning. The Council will, within one month, adopt a Recommendation for policymeasures setting a deadline for addressing the deviation, on the basis of a CommissionRecommendation, based on Art. 121.4 of the Treaty.If the Member State concerned fails to take appropriate action within five months, theCouncil will immediately adopt a Recommendation stating so, on the basis of a CommissionRecommendation based on article 121.4 of the Treaty. At the same time, an interest-bearingdeposit will be imposed on the euro area Member State (by reversed majority rule).The whole process will be no longer than six months. The time period of five months shallbe reduced to three if the Commission in its Recommendation to the Council considers thatthe situation is particularly serious and warrants urgent action.

-

-

22. The Task Force recommends introducing the following measures in thecorrective part of theSGP:-When a Member State, which has already been subject to interest bearing deposit under thepreventive arm of the SGP, is placed in EDP, the interest-bearing deposit is transformed intoa non- interest-bearing deposit.As a rule, when a Member State placed in EDP has not been subject to an interest-bearingdeposit under the preventive arm, the Council will adopt a Recommendation, setting adeadline for effective action on the basis of a Commission Recommendation. In case ofparticularly serious policy slippages, sanctions could immediately be applied by the Councilon the basis of a Commission recommendation.If the Council decides on the basis of article 126.8 of the Treaty that the Member State hasnot taken effective action to correct the excessive deficit within the given deadline, a finewill be applied, to be decided by reverse majority rule.If the Council finds that the Member State persists in failing to put into practice itsrecommendations (article 126.9 of the Treaty), the fine will be applied in line with existingprovisions of the SGP including a variable component related to the level of the deficit.

-

-

-

6

-

When warranted by the situation, the steps under the EDP should be accelerated (e.g. thedeadline for effective action could be reduced to three months rather than six months).

23. These new sanctions and compliance measures cannot apply retroactively. A transition phasefor some elements of these proposals will be required.

c) the decision making procedure on these new financial enforcement measures shouldensure a higher degree of automaticity24. A reverse majority rule should be adopted in the context of the secondary legislation to the newenforcement measures proposed (i.e. interest-bearing deposit in the preventive part of the Pact,non-interest-bearing deposit when a country is placed in EDP, fine in case of non compliance).For the later stage of sanction (i.e. increased fine in case of persistent lack of compliance)currently foreseen in the Treaty, the usual majority rule within the Council will continue toapply.25. Decisions on the new enforcement measures should be based on CommissionRecommendations. The Commission Recommendations would be adopted unless a qualifiedmajority of Member States in the Council vote against within a given deadline. Thepracticalities of the decision process should be precisely defined in the legislative process.26. This would increase the automaticity in the decision-making in relation with budgetarydiscipline, enhance considerably the role of the Commission and contribute to the credibility ofthe rules-based system. The Commission will adopt all necessary steps to ensure that it willfulfil its responsibilities in full independence and apply strictly the steps foreseen.2.1.3 Enhancing national fiscal rules and frameworks27. The Task Force has acknowledged the need to strengthen the Member States' ownership of EUfiscal rules. Enhancing national budgetary frameworks2and ensuring compliance with EU fiscalrules is key to strengthening budget discipline and ensuring compliance with the SGP. This isparticularly important since in the EMU architecture fiscal policy decisions remaindecentralised.28. A two-tier approach is recommended. A set of agreed minimum requirements for nationalframeworks needs to be met. All national fiscal frameworks should meet requirements in thefollowing areas no later than end 2013: (i) public accounting systems and statistics; (ii)numerical rules; (iii) forecasting systems; (iv) effective medium-term budgetary frameworks;and (v) adequate coverage of general government finances.29. Over and above these minimum requirements, a set of non-binding additional standards shouldbe agreed upon, covering notably the use of top down budgetary processes, fiscal rules and therole of public bodies (e.g. fiscal councils) tasked with providing independent analysis,assessments and forecasts related to domestic fiscal policy matters.

2

A national fiscal framework is the set of elements that underpin national fiscal governance, i.e. the country-specificinstitutional, legislative and regulatory frameworks that shape the design and implementation of fiscal policy at thecountry level.

7

30. To enhance their credibility and ensure consistency across Member States, the EuropeanCommission and the Council would assess the effectiveness of national fiscal frameworks whenassessing stability and convergence programmes and if necessary issue recommendations tostrengthen them.2.1.4 Improved quality of statistical data31. Stronger surveillance and enforcement mechanisms must rest on transparent, reliable and timelystatistics. A regulation reinforcing the audit powers of Eurostat has recently been agreed by theCouncil3. But further steps, including to strengthen further the professional independence of theEuropean Statistical System as well as Eurostat's audit powers should be considered. Sanctionsfor repeated statistical problems, such as lack of validation of data by Eurostat, should also beconsidered. The binding nature of the “European statistics code of practice” should bereinforced and some of the minimum standards should be enshrined in a legal act. Fullimplementation of the provisions in the code needs to be accelerated, in particular to reinforcemandates for data collection, and to further enhance quality.2.2Broadening economic surveillance and deepening coordination

2.2.1 A new surveillance mechanism32. Persistent and large macroeconomic imbalances and divergences in competitiveness,particularly among euro-area Member States, aggravate the vulnerability of the EU economyand are a threat to the smooth functioning of the monetary union. The global crisis hasdemonstrated that compliance with the SGP is not enough. Consumption developments, housingbubbles and the accumulation of external and internal debt in some Member States deepened theimpact of the crisis and constrained the capacity to respond. Given the high degree of economicand financial interdependence, particularly among euro-area Member States, such imbalancesmay create serious spill-overs that threaten the stability of the EU economy as a whole.33. As regards the euro area, action to address macroeconomic imbalances and divergences incompetitiveness is required in all Member States, but the nature, importance and urgency of thepolicy challenges differ significantly depending on the Member States concerned. Givenvulnerabilities and the magnitude of the adjustment required, the need for policy action isparticularly pressing in Member States showing persistently large current-account deficits andlarge competitiveness losses. Also, in Member States that have accumulated large current-account surpluses, policies should aim to identify and implement the structural reforms that helpstrengthening their domestic demand and growth potential.34. The Task Force recommends deeper macro-economic surveillance with the introduction of anew mechanism underpinned by a new legal framework based on Article 121 TFEU alongsidethe SGP applying to all EU Member States, taking into account the specificity of the euro area.The implementation of this mechanism would be done in a way to ensure consistency with thesurveillance of fiscal policies, growth-enhancing structural reforms and macro-financialstability, and to avoid duplication and overlap.

3

Council Regulation (EU) No 679/2010 of 26 July 2010 on the quality of statistical data in the context of the excessivedeficit procedure.

8

35. This new surveillance framework should rest on a two-stage approach:(i) First, an annual assessment of the risk of macroeconomic imbalances and vulnerabilities, inthe context of the assessments of Member States' National Reform Programs (NRPs) andStability and Convergence Programs, including an alert mechanism based on a scoreboardcovering a limited number of indicators and economic analysis. The Commission shouldconduct an in-depth analysis of the concerned Member State if the alert mechanism signalsactual or potentially excessive imbalances. This in-depth analysis could include countrysurveillance missions conducted by the Commission, in liaison with the ECB for euro area andERM II Member States.(ii) Second, an enforcement framework involving a corrective phase designed to enforce theimplementation of remedies in case of harmful macroeconomic imbalances.2.2.1.1 Indicators36. This surveillance mechanism should be based on practical, simple, measurable and availableindicators. The scoreboard of indicators, and in particular alert thresholds, should bedifferentiated for euro and non-euro area Member States in order to take into account specificfeatures of the monetary union and reflect relevant economic circumstances. The Commissionwill establish a list of indicators which should be endorsed by the Council and updated asappropriate.2.2.1.2 Enforcement37. When economic policies of a Member State are not consistent with the broad economic policyguidelines, or risk jeopardising the proper functioning of economic and monetary union, theCommission may address an early warning directly to the Member State concerned. In case ofparticularly serious imbalances, the Council should decide to place the Member State in an"excessive imbalances position" based on a recommendation by the Commission. This wouldtrigger the ‘corrective arm’ of the mechanism based on Article 121.4. A set of policyrecommendations to correct the imbalances should be addressed to the Member State concernedby the Council on the basis of Commission recommendations. To the extent Councilrecommendations address fiscal policies, they must be consistent with recommendationsprovided under the SGP. Without prejudice to the overall co-ordinating role of the ECOFINCouncil, the Competitiveness and EPSCO Council formations may usefully be involved if thescope of the recommendations encompasses issues under their competence.38. The Member State concerned should be obliged to report regularly on the progress ofimplementation. In addition, the Commission, should monitor the implementation of therecommendations, including through surveillance missions when appropriate, in the context ofthe excessive imbalances procedure, in liaison with the ECB for euro area and ERM II MemberStates. If the recommendations are not implemented, the conclusions of the missions will bemade public and reporting to the European Council will follow.39. For euro area Member States the enforcement mechanism should ultimately lead to sanctions incase of repeated non-compliance with the Council recommendations. As in this area there maybe long lags between the adoption of the corrective action and the actual resolution of theimbalances, and not necessarily a direct causality, the assessment of the Council should focus onthe effective implementation of the recommended actions.

9

40. The Council decisions concerning the sanctions based on Article 136 of the Treaty on thefunctioning of the EU will be made only by euro-area Member States. The vote of the memberof the Council representing the Member State concerned by the decisions shall not be taken intoaccount.41. The same decision making process proposed above for the new sanctions regime under the SGPshould also apply to all the new enforcement measures for the macro-economic surveillancemechanism.

2.2.2 Deeper and broader coordination - the "European semester"42. On the basis of the previous recommendations by the Task Force, a reinforced cycle of policycoordination, the so-called "European semester", has already been endorsed by the EuropeanCouncil and decided by the Council. It will be implemented as of 1st January 2011.43. This cycle of reinforced ex-ante coordination will cover all elements of economic surveillance,including policies to ensure fiscal discipline, macroeconomic stability, and to foster growth, inline with the Europe 2020 Strategy. Existing processes – e.g. under the SGP and the BroadEconomic Policy Guidelines – will be aligned in terms of timing while remaining legallyseparate. Stability and Convergence Programmes and National Reform Programmes will besubmitted by Member States at the same time in the spring and assessed simultaneously by theEuropean Commission.44. This earlier discussion at EU level will contribute to ensure that the EU/euro area dimension isbetter taken into account when countries prepare budgets and reform programmes, and willtherefore contribute to a higher degree of policy coordination among Member States . In orderto ensure that macro-financial stability issues are also considered alongside macro-economic,fiscal and structural policies, the relevant communications from the European Systemic RiskBoard (such as warnings and recommendations) should be taken into account.45. In order to further reinforce national ownership of the recommendations issued under the"European semester", governments, when submitting the draft budget to the national parliamentare expected to include policy recommendations by the Council and / or the Commissionaccompanied by an explanation of how these have been incorporated.2.3Towards a robust framework for crisis management

46. The Greek crisis showed that a more robust framework for crisis management is needed. Indeed,the recent events have demonstrated that financial distress in one Member State can rapidlythreaten macro-financial stability of the EU as a whole through various contagion channels. Thisis particularly true for the euro area where the economies, and the financial sectors in particular,are closely intertwined and where crisis management facilities were missing.47. Since the creation of the Task Force, the European Financial Stability Facility (EFSF) for theeuro area Member States and the European Financial Stability Mechanism (EFSM) have beenset up and are now fully operational, offering therefore a good line of defence for the next threeyears. They complement the balance of payments assistance to non-euro area Member States(based on Article 143 of the Treaty).

10

48. The Task Force considers that in the medium term there is a need to establish a credible crisisresolution framework for the euro area capable of addressing financial distress and avoidingcontagion. It will need to resolutely address the moral hazard that is implicit in any ex-antecrisis scheme. It should inter alia strengthen incentives for Member States to pursue sound fiscaland overall macroeconomic policies and for financial market participants to lend responsibly,while respecting the prerogatives and the independence of the European System of CentralBanks.49. Such a new mechanism needs to help prevent financial instability in the euro area if there is norealistic prospect for continued access to market financing. Issues to be addressed for such anew future permanent mechanism may include the role of the private sector, the role of the IMFand the very strong conditionality under which such programmes should operate.50. The precise features and operational means of such a crisis mechanism will require furtherwork, including on the respective roles and responsibilities of the EU, the euro area and euroarea Member States. The Task Force notes the intention of the Commission to present anassessment of the functioning of various mechanisms in place as soon as feasible.2.4Stronger institutions for more effective economic governance

51. The Task Force identified and addressed gaps in the current economic governance framework.Economic governance should therefore be improved in view of the strong interdependence ofthe economies within the European Union and particularly within the euro area.52. Many issues related to more effective economic governance are an integral part of the otherareas addressed in this report - reinforcing the SGP, broadening economic surveillance, strongercoordination and national fiscal frameworks. But there are specific issues that require specialattention in order to reinforce both central and national fiscal institutions, and to set up a systemwith built-in incentives for fiscal discipline at all levels.53. At the national level, the Task Force recommends the use or setting up of public institutions orbodies to provide independent analysis, assessments and forecasts on domestic fiscal policymatters as a way to reinforcing fiscal governance and ensuring long-term sustainability (seesection 2.1.3 above).54. Reinforcing the role and independence of the European Commission on matters of fiscal andmacroeconomic surveillance is key for the credibility of the new framework. The Task Forcewelcomes the Commission's announcement to clearly distinguish the analysis and assessmentcarried out under the authority of the Commissioner for economic and monetary affairs from thedecision-making by the college on policy proposals to the Council. The role of the Council andthe Eurogroup in implementing the new surveillance and policy coordination framework in theEU and the euro area respectively will be essential.3.CONCLUSION

55. Endorsement by the European Council of the recommendations in the present report willcontribute to strengthening economic governance in the EU and the euro area and can beimplemented within the existing Treaties. Their implementation will provide the necessaryimpetus towards deeper economic and monetary union, respectively.56. Adoption of the secondary legislation will be needed for the implementation of many of theserecommendations. The Task Force calls on all parties to opt for a "fast track" approach, toensure the effective implementation of the new surveillance arrangements as soon as possible.11

57. The setting-up of a crisis resolution framework requires further work. As it may imply a needfor Treaty changes, depending on its specific features, it is an issue for the European Council.The European Council may, in addition, examine other open issues, such as the suspension ofvoting rights.___________________

12

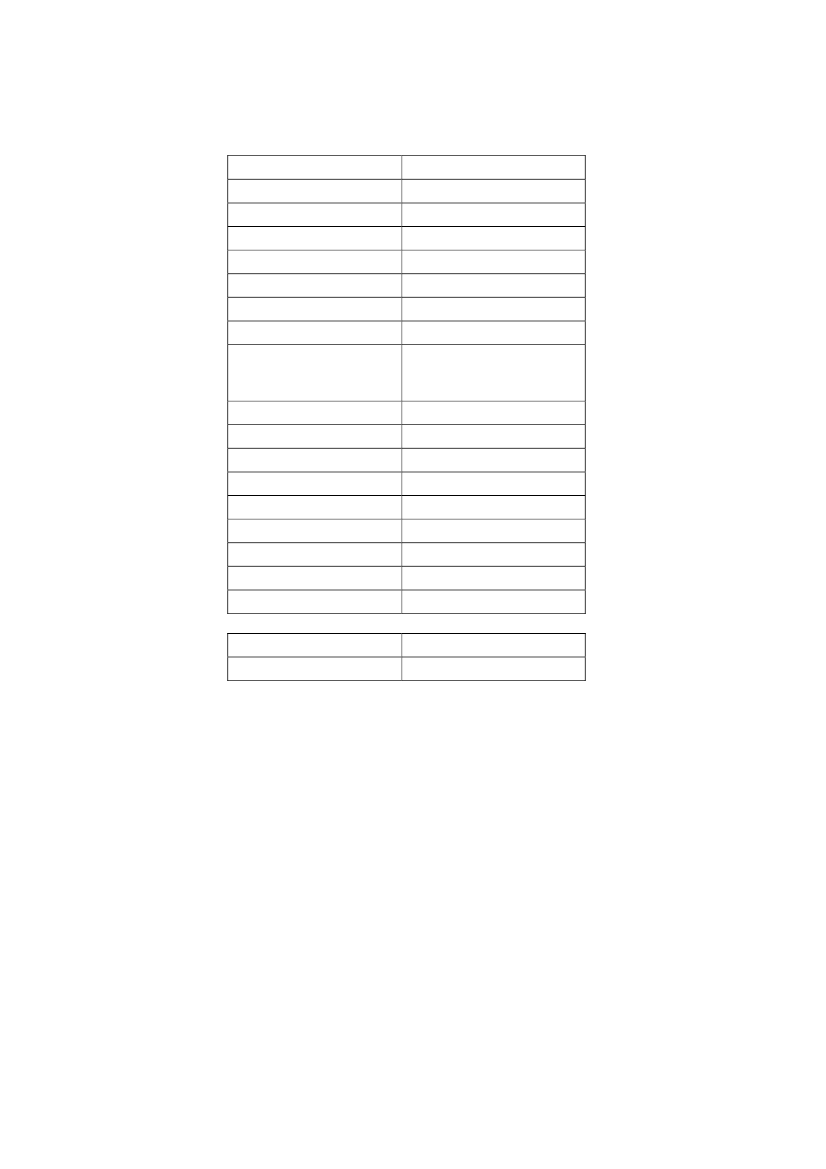

ANNEX 1COMPOSITION OF THE TASK FORCE - List of MembersPRESIDENT OF THE TASK FORCEEUROPEAN COMMISSIONEUROPEAN CENTRAL BANKEUROGROUPAUSTRIABELGIUMBULGARIACYPRUSCZECH REPUBLICMr Herman Van RompuyMr Olli RehnMr Jean-Claude Trichet (*)Mr Jean-Claude JunckerMr Josef PröllMr Didier ReyndersMr Simeon DjankovMr Charilaos StavrakisMr Eduard JanotaMr Miroslav KalousekDENMARKIRELANDESTONIAMr Claus Hjorth FrederiksenMr Brian LenihanMr Aare JärvanMr Jürgen LigiFINLANDFRANCEGERMANYGREECEHUNGARYMr Jyrki KatainenMs Christine LagardeMr Wolfgang SchäubleMr Georgios PapaconstantinouMr Péter OszkóMr György MatolcsyITALYMr Giulio Tremonti

13

LATVIA

Mr MārtiĦš BičevskisMr Einars Repse

LITHUANIALUXEMBOURGMALTANETHERLANDSPOLANDPORTUGALROMANIA

Ms. Ingrida ŠimonytéMr Luc FriedenMr Tonio FenechMr Jan Kees De JagerMr Jan Vincent-RostowskiMr Fernando Teixeira Dos SantosMr Sebastian VladescuMr Gheorghe Ialomitianu

SPAINSLOVAKIA

Ms Elena SalgadoMr Jan PočiatekMr Ivan Miklos

SLOVENIA

Mr Mitja GaspariMr Franc Križanič

SWEDENUNITED KINGDOM

Mr Anders BorgMr George Osborne

(*)The President of the ECB does not subscribe to all elements of this report

14

ANNEX 2Dates of Task Force meetings

TASK FORCE21 May 20107 June 201012 July 20106 September 201027 September 201018 October 2010

SHERPA TASK FORCE COMMITTEE1 June 201023 June 20105 July 201030 August 201021 September 20105 October 201012 October 2010

15

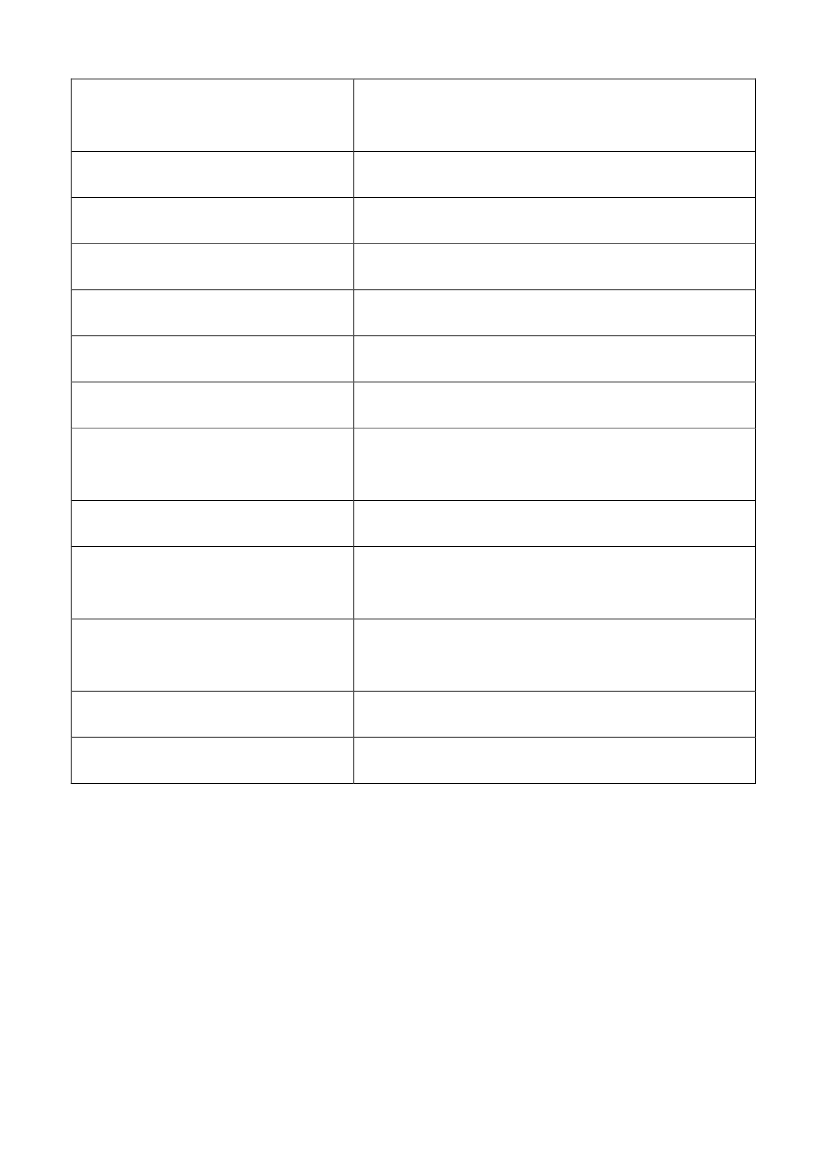

ANNEX 3Contributions of Member States and InstitutionsMemberState/InstitutionsAUSTRIABULGARIACYPRUSDENMARKESTONIAFINLANDFRANCEGERMANYITALYLUXEMBOURGNETHERLANDSPOLANDROMANIASLOVAKIASLOVENIASWEDENUNITED KINGDOMECBEuropean CommissionDate of submission31/05/101/06/1011/10/1027/08/105/07/102/06/1022/07/1020/05/10; 22/07/10;23/09/105/07/1010/06/1029/05/1031/05/101/06/102/06/102/06 and 7/07/103/06/109/07/1010/06/1017-18-29-30/06/10

___________________

16