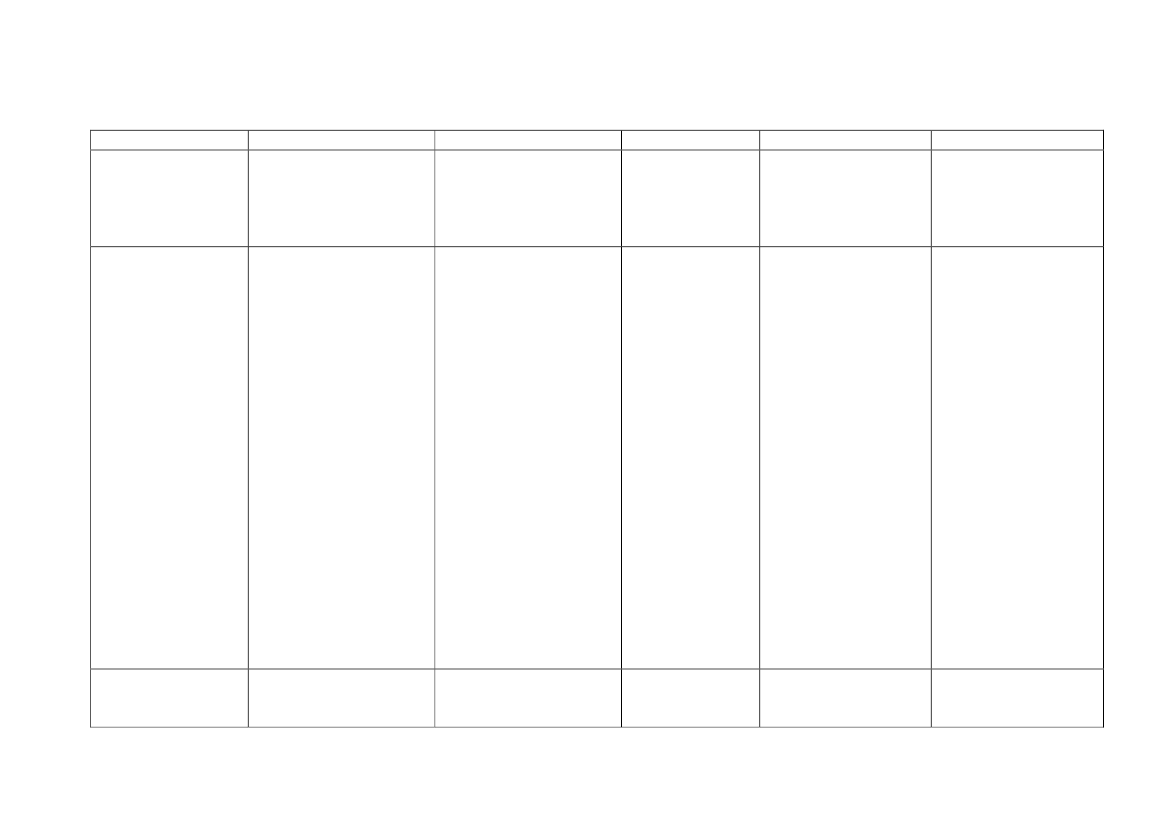

Annex – comparison of main features of national bank levies

Germany

Objective/destination Resolution fund

France

General budget

Further details in the

September budget

Hungary

General budget

Levy Basis

Bank's business volume,

size, degree of

integration in financial

markets. Liabilities to

other financial

institutions will be

considered.

A twofold base:

o

balance sheet

total minus liable

capital and

liabilities to

customers

o

value of

derivatives held

off balance sheet.

Capped at 15% of credit

institutions' annual

profits

"targeted on most risky

business of banks"

Sweden

Stability Fund (finance

measures to counteract

risk of serious

disturbance to SE

financial system)

On the basis of

The fee, which

0.5 percent of

amounts to 0.036 %

banks’ assets over per annum, is levied on

HUF 50 billion

the institution's

(app. EUR 180 m) liabilities (excluding

at the end of 2009 equity capital and

some junior debt

securities) according to

an approved balance

sheet.

Only 50% of the fee

will be charged in

2009 and 2010.

UK

General budget

Total liabilities (i.e.

both short and long

term

liabilities)

excluding:

•

•

•

Tier 1 capital;

insured retail

deposits;

repos secured

on sovereign

debt; and

policyholder

liabilities of

retail insurance

businesses

within banking

groups.

•

Scope

Credit institutions (i.e.

Prefer a broad scope

carrying out regulated

banking activities such as

Banks, insurers,

brokers, and other

financial service

7

New proposals planned

for 2011 on the

possible design of a

risk-differentiated fee

in a combined system

with the deposit

guarantee scheme

Banks and other credit Banks with aggregate

institutions

liabilities of £20 bln or

incorporated in

C:\TEMP\Temporary Internet Files\OLKC7\EFC-Note_BankLevies_FINAL230810.doc