Corporate Europe Observatory, Still not loving ISDS: 10 reasons to oppose investors’

super-rights in EU trade deals, 16 April 2014

http://corporateeurope.org/international-trade/2014/04/still-not-loving-isds-10-reasons-

oppose-investors-super-rights-eu-trade

Annex 1: Reality check of the Commission’s plans for ‘reform’ of “substantive”

investor rights

When European Trade Commissioner Karel de Gucht launched the public consultation on the investor

rights in the proposed EU-US trade deal (TTIP), he

said:

“I fully agree with the many critics who

claim that investor-to-state-dispute settlement (ISDS) up until now has resulted in some very worrying

examples of litigation against the state.” The problem, according to de Gucht, lies in some problematic

features of existing investment agreements – which the Commission claims to “re-do” to build a

“legally water-tight system”.

This Annex looks into the Commission plans to re-do the so called “substantive” investor rights

(Annex 2 is on their proposals to reform the dispute settlement system). The Commission claims that

it will introduce “clear and innovative provisions” with regards to some of the traditionally vaguely

formulated investor rights so that they “cannot be interpreted by arbitral tribunals in a way that is

detrimental to the right to regulate”. Because, it argues, “in the end, the decisions of arbitral tribunals

are only as good as the provisions that they have to interpret and apply,” (question 5 in the

Commission's

consultation document).

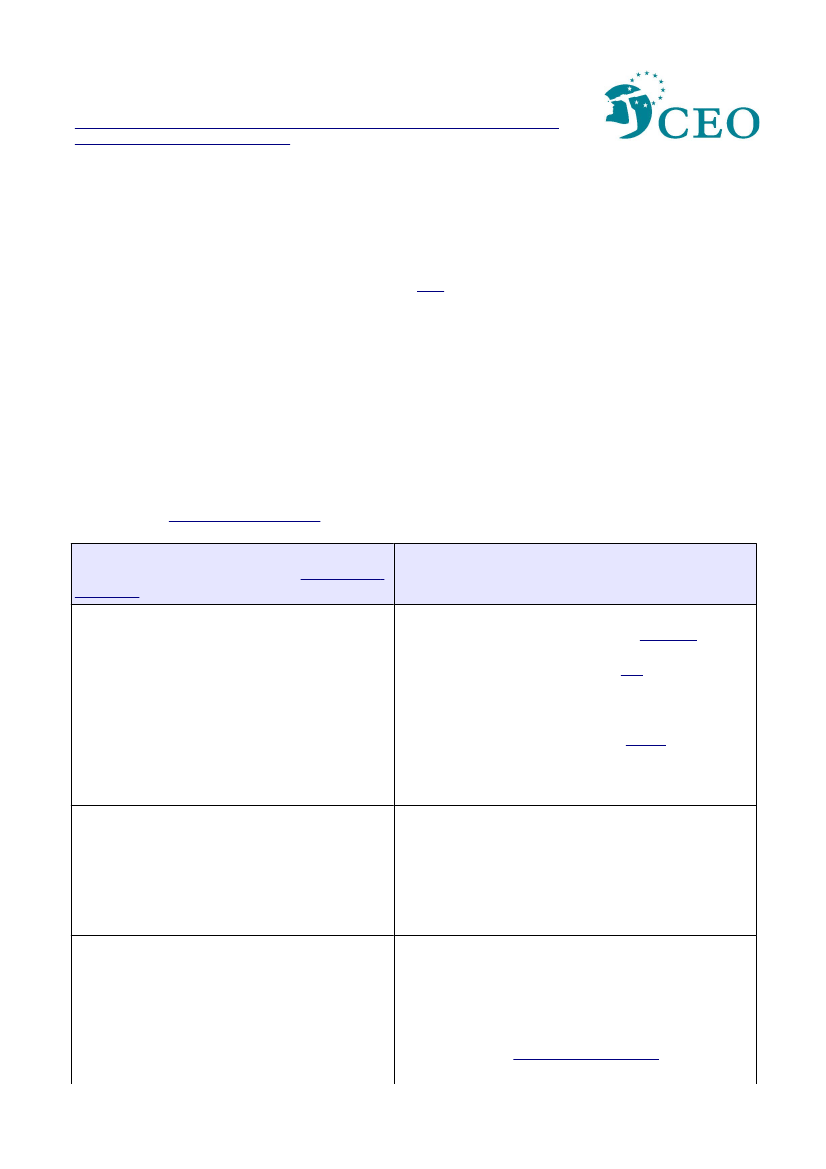

PR-speak:

what the Commission claims in its

consultation

document

The EU wants to make sure that states’

right to

regulate

is “confirmed as the basic underlying

principle” of the EU-US agreement so that

arbitrators “have to take this principle into

account” when assessing an investor-state dispute.

The Commission quotes a section of the preamble

of the EU-Canada agreement (seen as a template

for TTIP) that indeed recognises the parties’ right

“to take measures to achieve legitimate public

policy objectives”, (from question 5 in the

consultation document).

The EU sees no problem with the “intentionally

broad”

definition of “investment”

in investment

treaties covering “a wide range of assets, such as

land, buildings, machinery, equipment, intellectual

property rights, contracts, licenses, shares, bonds,

and various financial instruments,” (from question

1).

The EU wants to avoid abuse by improving the

definition of “investor”

to eliminate so called

“shell” or “mailbox” companies from the scope of

the agreement: “to qualify as a legitimate investor

of a Party, a juridical person must have substantial

business activities in the territory of that Party,”

(from question 1).

Reality check:

what the Commission really does

– and what it means in practice

It is impossible to check the claim with just an excerpt of

the preamble. According to a Canadian

summary

of it, the

‘right to regulate’ is specified (“in a manner consistent

with the Agreement”). According to

this

analysis from the

International Institute for Sustainable Development

(IISD, p.2), this detail puts the investor rights above the

right to regulate – the exact opposite of what the

Commission claims. During a public

debate

in March, a

high-ranking Commission official admitted that the

formulation on the right to regulate will “not make any

difference” in investor-state disputes.

The definition of “investment” is key because it

determines what is covered by the chapter. A broad – and

open-ended – definition such as the Commission’s not

only covers actual enterprises in the host state, but a vast

universe ranging from holiday homes to sovereign debt,

exposing states to unpredictable legal risks.

The definition of “investor” is key because it determines

who is covered by the agreement. The EU seems to have

understood that a broad definition can lead to abuse of the

treaty via “treaty shopping”, allowing, for example, a US

firm to sue the US via a Dutch mailbox company. But

unfortunately, it fails to define the term “substantial

business activity”.

Thousands of investors

will be

covered by the chapter.