Corporate Europe Observatory, Still not loving ISDS: 10 reasons to oppose investors’ super-

rights in EU trade deals, 16 April 2014

http://corporateeurope.org/international-trade/2014/04/still-not-loving-isds-10-reasons-

oppose-investors-super-rights-eu-trade

Annex 2: Reality check of the Commission’s plans for ‘reform’ of “investor-state

dispute settlement”

When European Trade Commissioner Karel de Gucht launched the public consultation on the

investor rights in the proposed EU-US trade deal (TTIP), he

said:

“I fully agree with the many

critics who claim that investor-to-state-dispute settlement (ISDS) up until now has resulted in some

very worrying examples of litigation against the state.” The problem, according to de Gucht, lies in

some problematic features of existing investment agreements – which the Commission claims to

“re-do” to build a “legally water-tight system”.

This Annex looks into the Commission plans to “re-do” the investor-state dispute settlement process

(ISDS) through which EU and US companies could directly sue governments for alleged violations

of TTIP’s “substantive” investor rights (analysed in Annex 1). The Commission promises to

“improve” the mechanism “to ensure a transparent, accountable and well-functioning ISDS system

that reflects the public interest and policy objectives,” (section B in the Commission's

consultation

document).

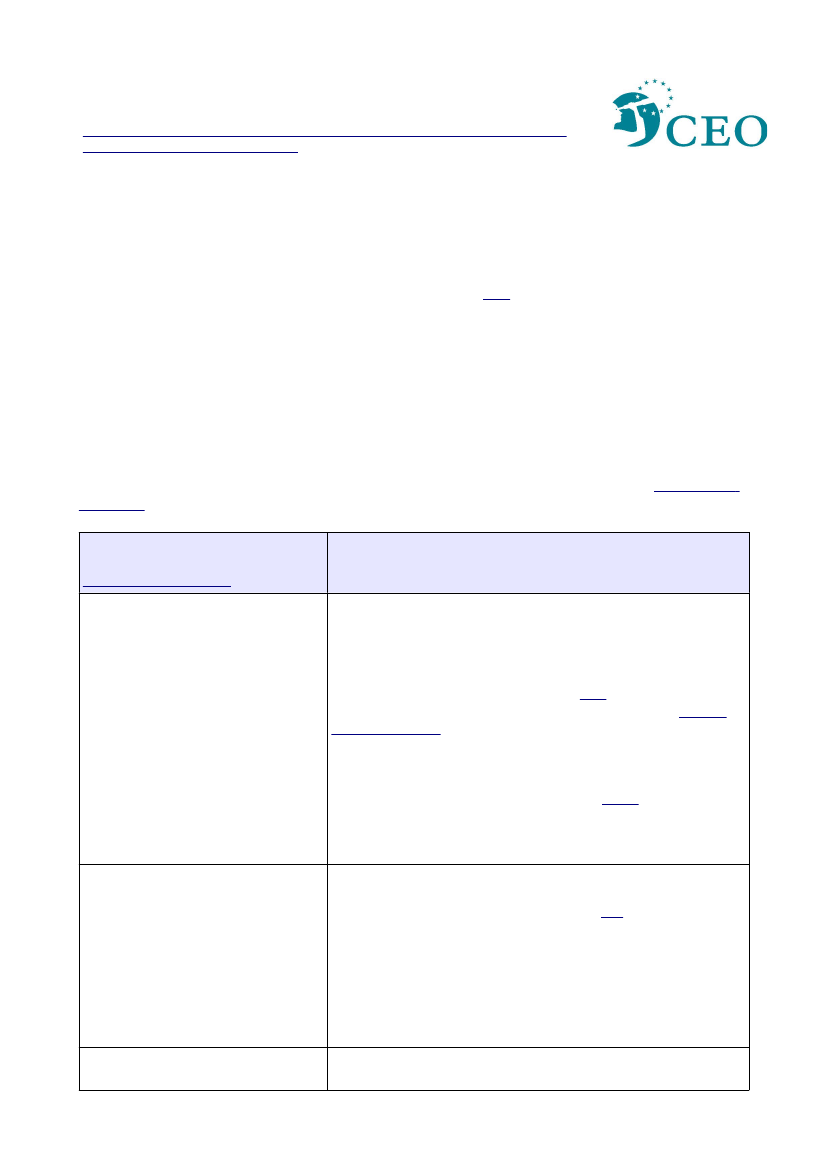

PR-speak:

what the Commission claims in its

consultation document

The EU will introduce a “binding

code

of conduct”

for arbitrators in investor-

state dispute tribunals to ensure that

they are independent and act ethically.

If an arbitrator violates this code

“he/she will be removed from the

tribunal,” (from question 8 in the

consultation document).

Reality check:

what the Commission really does

–

and what it means in practice

This responds to concerns about conflicts of interest among the 3-

lawyer panels which decide investor-state claims. Unlike judges,

they have no flat salary but earn more the more claims they rule on

– a strong incentive to side with the only one side which can bring

claims (the investors). Existing rules and codes have sometimes led

to the disqualification of arbitrators (see

here

for a recent case & an

overview of existing rules). But they have not prevented

a small

club of arbitrators

from ruling on the majority of disputes, allowing

for more business in the future with investor-friendly

interpretations of the law. It is unlikely that the EU’s code of

conduct will ban this global elite club of ‘entrepreneurial

arbitrators’ (as Singapore’s attorney general

called

them). A 20

February leaked version of the Commission’s proposal from the

EU-Singapore talks does not even define what a “conflict of

interest” is.

A similar roster already exists at the tribunal most often used for

investor-state claims, the International Centre for Settlement of

Investment Disputes (ICSID). According to

this

analysis by the

International Institute for Sustainable Development (IISD, p.22), it

“has not helped mitigate concerns of impartiality and independence

of arbitrators”. Like the ICSID roster, the one proposed by the EU

will only be a “backup” for the third arbitrator – not an “exclusive

roster for all the arbitrators fulfilling strict conditions of

experience, independence and impartiality”. So, concerns about

arbitrator bias will not really be addressed by the roster.

In most investor-state disputes, little or no information is released

to the public. But opacity has become the achilles heel of the

The EU wants to set up a list (roster)

of qualified arbitrators, from which the

chairperson of an ISDS tribunal will be

picked if the parties cannot otherwise

agree on one. This would “ensure” the

“abilities and independence” of these

arbitrators whom the EU and the US

vetted and agreed to, (from question

8).

The EU’s aim is “to ensure

transparency

and

openness”

in